QS Insight

QuantaSutra intelligently consolidates various data sources into one destination. Raw consolidated data truth.

QuantaSutra Insight transforms mountains of raw data into actionable intelligence. Our system provides a set of predefined templates which let you unify hundreds of factors, indicators and signals into a single view. Templates automatically handle tricky aspects of data like missing data or weak signals. Even combining data from different geographic regions with different calendar systems is a breeze. Imagine exotic datasets from temperatures to car counts unified with traditional financial data and your team’s internal data.

In addition to real time updates of the data you generate throughout the day, QuantaSutra will load all of your historical data too, giving you access to the most complete picture of your business possible.

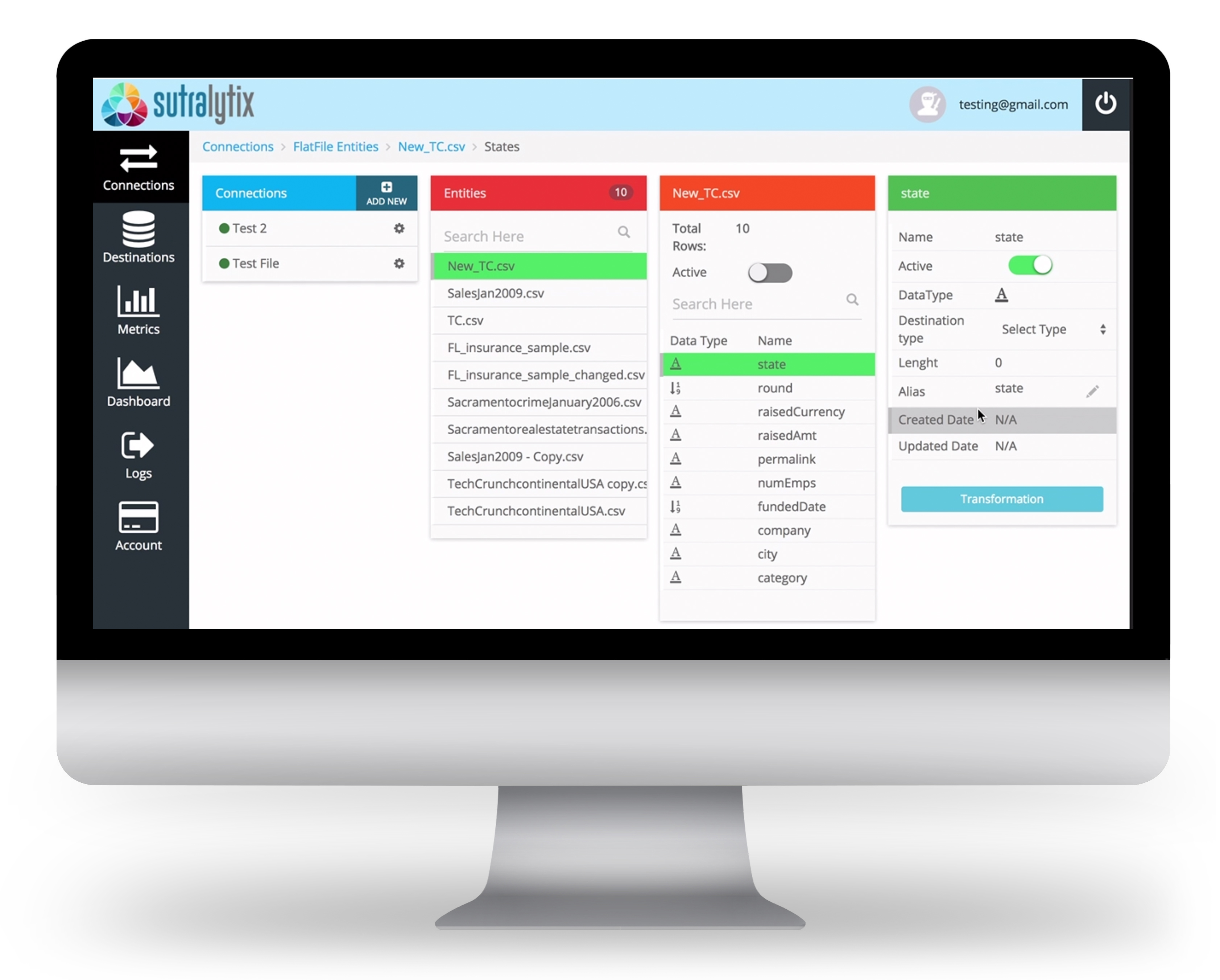

QuantaSutra makes it easy to quickly integrate a variety of data into one place. Choose what data to integrate down to specific fields. Select where you integrate your data to meet compliance or security needs. Decide how often to update your data to quickly capture and report the KPIs and insights that drive your business. As compared to standard ETL processes, QuantaSutra scales quickly, economically, and usually with the need for IT support. This lets you focus on using data to gain valuable insights in real time across your data universe.

With the power of insight, your team’s investment strategy can be automated into a system of alerts which monitors sophisticated market conditions without being glued to a terminal.

Insight Provides Predefined Templates For

- Time Series Data Integration

- Managing Missing Data Cells

- Predictive Analytics

- Systematic Risk Analysis

- Momentum and Trend Following

- Moving Average Crossover

Like a self-driving car, Insight can make the same investment decisions automatically that would normally take hours of terminal or spreadsheet time. Best of all, it monitors the indicators automatically and alerts your team only when trading conditions are met.

How does it work?

Define your strategy requirements like what equities to review with an online spreadsheet from any number of sources. Then add additional transformations like data cleansing and predictive analytics. Finally, set up allocation rules or recommendation alerts. Your team can untether from the terminal and focus on growing the business.